All Categories

Featured

Table of Contents

There is no payment if the policy runs out before your death or you live past the policy term. You might be able to restore a term policy at expiry, but the premiums will be recalculated based on your age at the time of renewal.

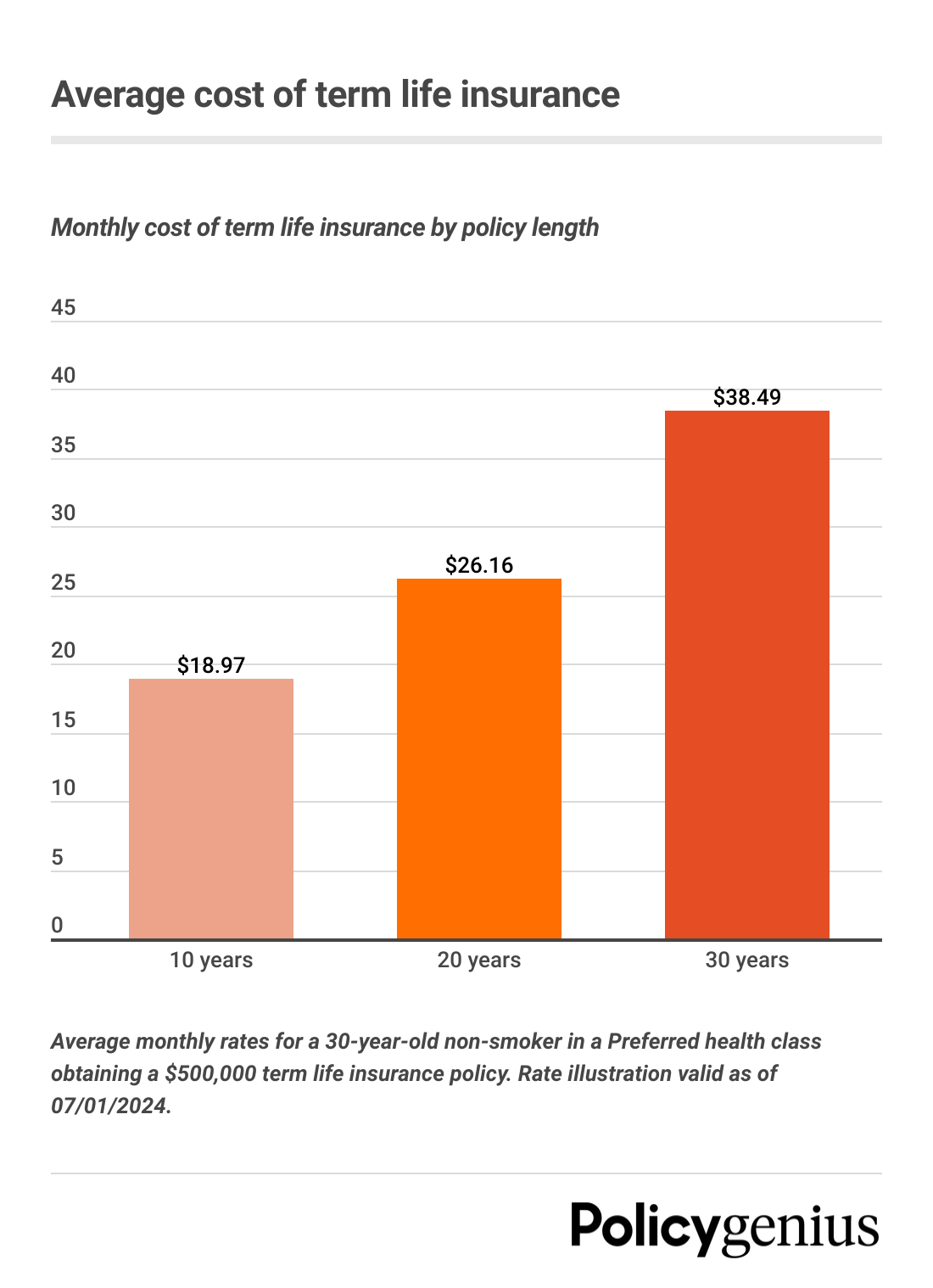

At age 50, the premium would certainly climb to $67 a month. Term Life Insurance Rates 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life policy, for males and women in outstanding wellness.

What Is A Ten Year Term Life Insurance Policy

Rate of interest prices, the financials of the insurance policy company, and state regulations can additionally influence costs. When you take into consideration the quantity of coverage you can obtain for your costs bucks, term life insurance policy has a tendency to be the least costly life insurance.

Thirty-year-old George wishes to safeguard his family in the not likely occasion of his sudden death. He gets a 10-year, $500,000 term life insurance plan with a premium of $50 per month. If George passes away within the 10-year term, the plan will certainly pay George's beneficiary $500,000. If he dies after the policy has ended, his beneficiary will certainly get no advantage.

If George is identified with a terminal ailment throughout the very first policy term, he probably will not be eligible to restore the plan when it runs out. Some plans provide ensured re-insurability (without evidence of insurability), but such functions come at a greater price. There are numerous sorts of term life insurance policy.

Normally, most companies supply terms ranging from 10 to 30 years, although a couple of offer 35- and 40-year terms. Level-premium insurance coverage (term life insurance as collateral for a loan) has a set month-to-month repayment for the life of the policy. Most term life insurance coverage has a level costs, and it's the type we have actually been describing in many of this article.

The Combination Of Whole Life And Blank Term Insurance Is Referred To As Family Income Policy

Term life insurance policy is attractive to young individuals with youngsters. Parents can acquire considerable protection for an inexpensive, and if the insured dies while the policy holds, the household can rely on the survivor benefit to change lost revenue. These plans are also fit for people with growing households.

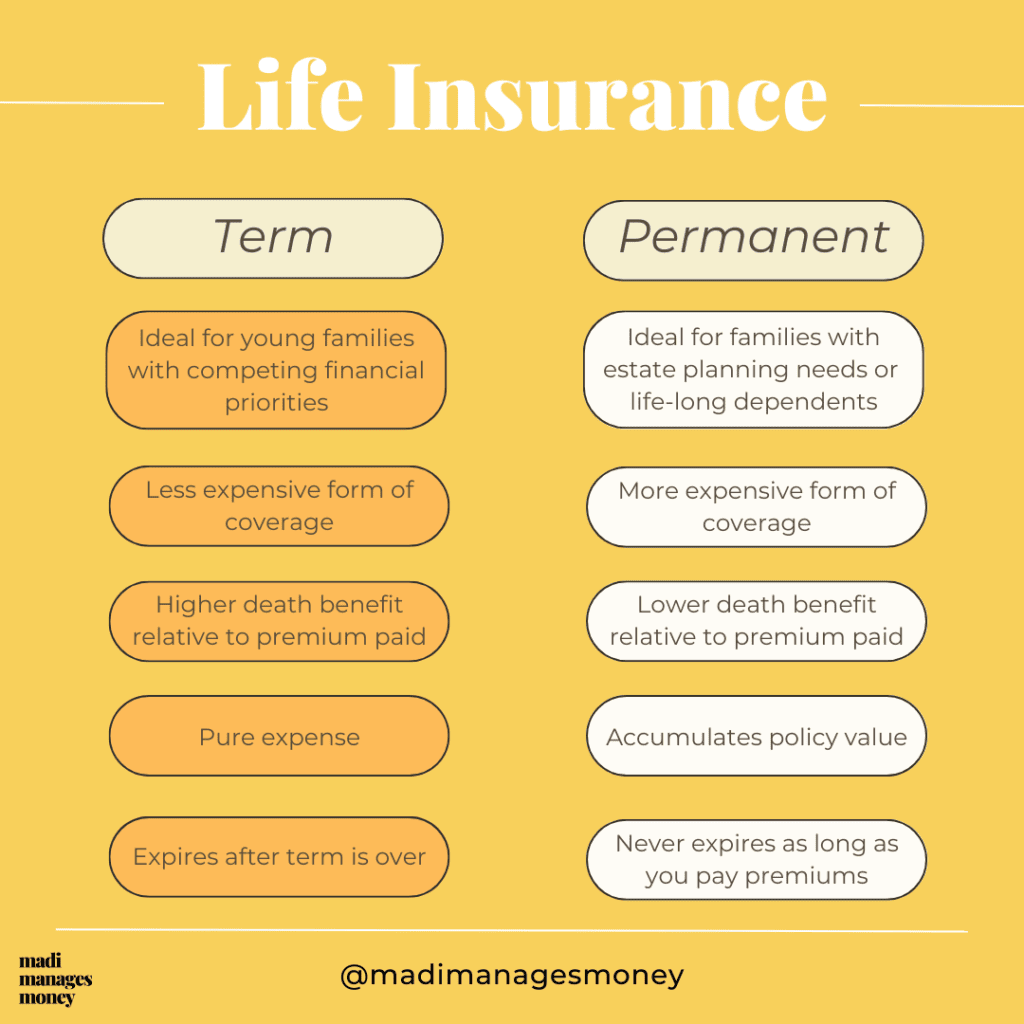

Term life plans are perfect for individuals who desire considerable insurance coverage at a reduced price. Individuals who have whole life insurance policy pay more in costs for less coverage however have the safety of recognizing they are shielded for life.

The conversion cyclist need to permit you to convert to any type of long-term policy the insurer supplies without restrictions - what does 15 year term life insurance mean. The main attributes of the rider are preserving the initial wellness rating of the term plan upon conversion (even if you later on have health issues or end up being uninsurable) and determining when and how much of the insurance coverage to convert

Certainly, total costs will certainly increase substantially because whole life insurance policy is more costly than term life insurance policy. The benefit is the guaranteed approval without a clinical examination. Clinical conditions that develop throughout the term life period can not create premiums to be boosted. Nevertheless, the firm might call for minimal or full underwriting if you intend to add added bikers to the new policy, such as a long-term treatment rider.

Entire life insurance comes with considerably greater regular monthly costs. It is meant to supply coverage for as lengthy as you live.

Compare Decreasing Term Life Insurance

Insurance policy companies established a maximum age limitation for term life insurance coverage plans. The costs additionally climbs with age, so an individual aged 60 or 70 will certainly pay substantially even more than a person decades younger.

Term life is rather similar to vehicle insurance coverage. It's statistically not likely that you'll need it, and the costs are cash away if you don't. But if the most awful takes place, your family will obtain the advantages.

This plan layout is for the client that requires life insurance policy but would certainly such as to have the capability to select just how their money worth is invested. Variable policies are underwritten by National Life and distributed by Equity Services, Inc., Registered Broker/Dealer Associate of National Life Insurance Business, One National Life Drive, Montpelier, Vermont 05604.

For J.D. Power 2024 honor details, go to Permanent life insurance coverage creates money value that can be borrowed. Policy fundings accrue passion and unpaid policy car loans and rate of interest will certainly minimize the survivor benefit and cash worth of the policy. The amount of money value available will generally depend on the kind of long-term plan bought, the quantity of protection purchased, the length of time the policy has been in pressure and any kind of impressive plan lendings.

Second To Die Term Life Insurance

A total statement of insurance coverage is found only in the policy. Insurance plans and/or linked motorcyclists and functions might not be available in all states, and policy terms and conditions might vary by state.

The primary differences in between the various sorts of term life plans on the market have to do with the size of the term and the coverage amount they offer.Level term life insurance policy features both level premiums and a level survivor benefit, which implies they remain the very same throughout the duration of the policy.

It can be restored on a yearly basis, however premiums will increase every single time you renew the policy.Increasing term life insurance policy, also referred to as an incremental term life insurance policy strategy, is a plan that comes with a survivor benefit that raises in time. It's usually extra intricate and costly than level term.Decreasing term life insurance policy features a payment that reduces gradually. Usual life insurance policy term lengths Term life insurance policy is budget-friendly.

Although 50 %of non-life insurance coverage proprietors mention expense as a factor they don't have coverage, term life is among the cheapest type of life insurance policy. You can frequently get the protection you need at a manageable price. Term life is simple to take care of and comprehend. It offers protection when you most need it. Term life uses economic defense

during the period of your life when you have major economic obligations to fulfill, like paying a mortgage or moneying your children's education. Term life insurance coverage has an expiration date. At the end of the term, you'll need to purchase a new policy, restore it at a higher premium, or transform it into permanent life insurance policy if you still desire insurance coverage. Rates might differ by insurer, term, protection quantity, health class, and state. Not all policies are available in all states. Price image valid since 10/01/2024. What aspects affect the cost of term life insurance policy? Your rates are determined by your age, sex, and wellness, in addition to the coverage amount and term length you choose. Term life is an excellent fit if you're looking for a budget-friendly life insurance coverage policy that just lasts for a collection duration of time. If you need irreversible coverage or are considering life insurance policy as an investment alternative, entire life could be a better choice for you. The main differences in between term life and entire life are: The size of your protection: Term life lasts for a collection amount of time and afterwards runs out. Ordinary monthly entire life insurance rate is computed for non-smokers in a Preferred health classification, obtaining an entire life insurance policy plan compensated at age 100 offered by Policygenius from MassMutual. Rates might differ by insurer, term, insurance coverage amount, wellness class, and state. Not all plans are available in all states. Temporary life insurance policy's momentary policy term can be an excellent alternative for a few situations: You're waiting for authorization on a long-lasting plan. Your plan has a waitingperiod. You're in between tasks. You want to cover momentary commitments, such as a car loan. You're enhancing your health and wellness or lifestyle(such as quitting cigarette smoking)prior to obtaining a standard life insurance policy policy. Aflac supplies various long-term life insurance policy plans, including whole life insurance coverage, final expenditure insurance, and term life insurance. Beginning talking with an agent today to find out even more concerning Aflac's life insurance policy items and locate the right alternative for you. The most preferred kind is now 20-year term. Most business will not offer term insurance policy to an applicant for a term that ends past his/her 80th birthday celebration . If a policy is"renewable," that indicates it continues active for an extra term or terms, approximately a specified age, even if the health and wellness of the guaranteed (or other variables )would certainly cause him or her to be rejected if she or he requested a brand-new life insurance plan. So, premiums for 5-year renewable term can be level for 5 years, after that to a new price showing the new age of the insured, and so forth every 5 years. Some longer term policies will certainly ensure that the premium will notboost during the term; others do not make that assurance, enabling the insurance provider to increase the price throughout the policy's term. This implies that the policy's proprietor has the right to alter it into a permanent kind of life insurance without extra proof of insurability. In most sorts of term insurance coverage, including homeowners and car insurance, if you haven't had a claim under the policy by the time it expires, you obtain no refund of the costs. Some term life insurance policy customers have actually been unhappy at this result, so some insurers have actually developed term life with a"return of premium" function. The costs for the insurance coverage with this function are usually dramatically more than for plans without it, and they usually need that you keep the policy effective to its term or else you forfeit the return of costs benefit. Married with little ones-Life insurance coverage can aid your partner keep your home, present lifestyle and attend to your children's assistance. Single moms and dad and single income producer- Life insurance coverage can help a caretaker cover child care costs and other living expenses and meet prepare for your child's future education and learning. Married without any children- Life insurance coverage can supply the cash to fulfill financial obligations and assist your partner keep the assets and way of life you've both strove to achieve. But you may have the choice to convert your term policy to irreversible life insurance policy. Insurance coverage that shields a person for a defined period and pays a death advantage if the covered person passes away during that time. Like all life insurance policy plans, term coverage helps maintain a household's economic health in situation a liked one passes away. What makes term insurance coverage various, is that the guaranteed individual is covered for a detailsquantity of time. Because these plans do not give lifelong coverage, they can be fairly cost effective when contrasted with an irreversible life insurance coverage plan with the same amount of coverage. While many term plans supply reliable, temporary protection, some are a lot more flexible than others. At New York City Life, our term policies offer a special mix of features that can help if you end up being handicapped,2 come to be terminally ill,3 or merely intend to transform to a permanent life plan.4 Considering that term life insurance coverage supplies momentary defense, numerous people like to match the size of their policy with a crucial landmark, such as repaying a mortgage or seeing kids with university. Level premium term could be more reliable if you desire the premiums you pay to continue to be the same for 10, 15, or 20 years. As soon as that duration ends, the amount you pay for insurance coverage will certainly increase annually. While both kinds of insurance coverage can be reliable, the choice to select one over the other boils down to your particular demands. Since no person knows what the future has in store, it is very important to see to it your protection is trustworthy sufficient to satisfy today's needsand adaptablesufficient to assist you get ready for tomorrow's. Here are some essential variables to bear in mind: When it comes to something this vital, you'll desire to ensure the business you utilize is economically audio and has a tested background of keeping its promises. Ask if there are attributes and benefits you can use in case your demands alter in the future.

Table of Contents

Latest Posts

Level Term 20 Life Insurance

Oregon Term Life Insurance

Couple Term Life Insurance

More

Latest Posts

Level Term 20 Life Insurance

Oregon Term Life Insurance

Couple Term Life Insurance